Nervous Nellies are panicking over current economic conditions in the US.

Nervous Nellies are panicking over current economic conditions in the US.

Here’s some perspective. In the last two centuries, the U.S. has experienced five depressions. Since 1854, we have had thirty-three economic slowdowns with the average contraction lasting one and one-half years and the average expansion beyond the contraction three years. Since 1948, we have had ten economic slowdowns with the average contraction lasting 11 months and the average expansion after the contraction lasting four years. Our last “real recession” was 2009. (The 2020 slowdown was not a traditional recession; it was Covid-induced and lasted a few months.) Since 2009, we’ve had 15 years of economic expansion.

We are way past overdue for a necessary economic slowdown, which purges the system of under-performing entities—governmental and business.

The threat of tariffs is wreaking panic on Wall Street and in the media. Yet, since 2009, the US has transferred nearly 10 trillion USD in wealth to other countries because of their unfair trade policies. The only thing that kept this ship afloat during this period (2016-2025) is the 10-plus trillion dollar government infusion of funds into the US economy which caused inflation. No one wants a recession on their watch; they would rather kick the can down the road than to purge the system of the inefficiencies that choke growth.

Now, the US is going through an economic reckoning as “outsiders” disrupt the status quo and attempt to right this ship of state. This change would never happen by the guardians of the status quo. This action requires people from the outside who are not invested in the current system. Short-term pain is an economic reality for which politicians have no appetite. Their answer is to pump more of our money into a bloated system of inefficiencies, paybacks, and graft.

This economic reckoning is a necessary part of the reconstruction of a broken system. It’s very much like medical procedures that heal diseases—you hate the process but love the outcome.

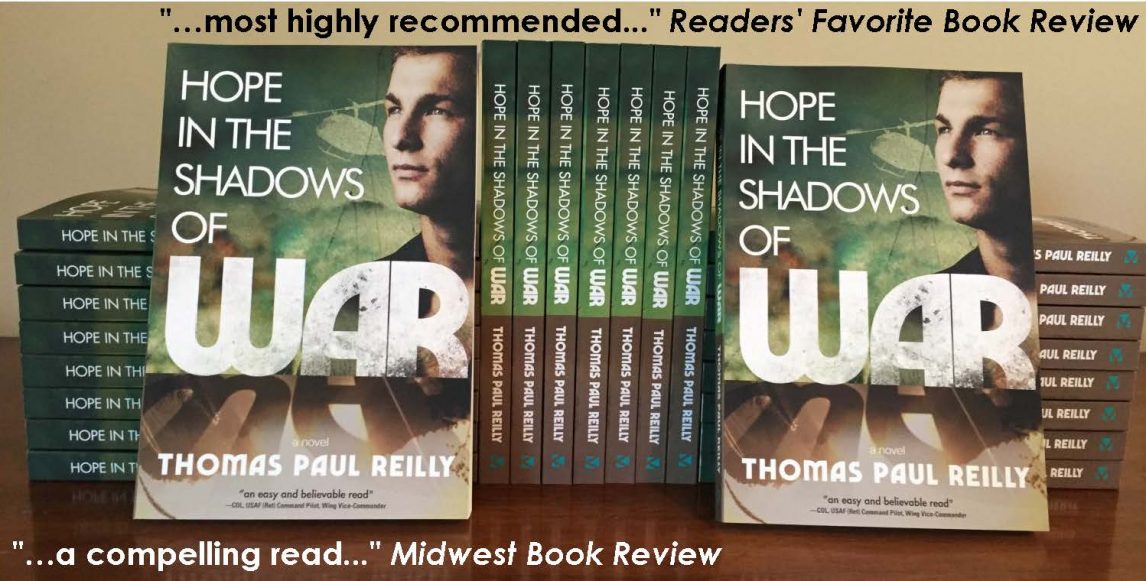

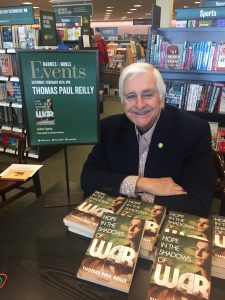

Tom Reilly is the author of 17 books, including How to Sell and Manage in Tough Times and Tough Markets.